The Only Guide for Paul B Insurance Part D

Table of ContentsThe Greatest Guide To Paul B Insurance Part DThe Main Principles Of Paul B Insurance Part D Paul B Insurance Part D Can Be Fun For EveryoneThe smart Trick of Paul B Insurance Part D That Nobody is Talking AboutThe Ultimate Guide To Paul B Insurance Part D

Maintaining your ACA strategy may also suggest handling late registration charges for Medicare in the future. If you have an Affordable Care Act (ACA) strategy, you can keep your coverage once you transform 65. Nevertheless, you can not keep any kind of superior tax credit ratings (or aids) when your Medicare Part A protection starts.Otherwise, you might be required to pay them when filing your tax obligations. If you help a business with 1-50 employees, you might be able to maintain your company protection via SHOP.7 Maintaining this plan will certainly allow you to delay Medicare registration - paul b insurance part d. You will not go through late registration penalties up until after this protection finishes.

If it will certainly become an additional coverage choice, it might be in your benefit to sign up for Medicare when you are initial eligible. Or else, your employer protection might refuse making repayments up until Medicare has been billed. This might place you in a pricey, and discouraging, coverage hole.

You may face extra expenses if you postpone signing up in a Medicare Supplement strategy. It's important to note that only certain plans enable you to delay signing up in Medicare without encountering penalties. Medicare Component A The majority of people receive premium-free Part A since they have helped at the very least ten years in America.

Paul B Insurance Part D - An Overview

Your monthly premium could raise by 10% for each and every year you didn't register. This fine lasts for two times as several years as you postponed protection. 8 For example, if you postponed registering in Medicare for 4 years, you'll have to pay a greater premium for 8 years. Medicare Part B The Component B fine is a lifelong effect to delaying your Medicare insurance coverage.

9 As an example, if your IEP finished in December 2017, and you waited up until March 2020 to register for Part B, you would run into a 20% premium charge (2 complete 12-month periods without protection). Medicare Component D The Component D penalty is likewise long-lasting and begins once you have had no prescription medication insurance coverage for greater than 63 days.

37 in 2022) for every month you were not covered. 10 As an example, if you do without prescription medication insurance coverage from December 2020 through February 2022 (14 months), that's a 14% penalty, or $4. 70 each month. Medicare Supplement (Medigap) Plans There read review are no penalties for obtaining a Medigap strategy after your registration period.

Health, Health and wellness can help you aid Medicare quotes online prices quote compare them contrast your current coverageExisting protection no cost to price. Plus, Wellness, Markets can even assist you figure out which intend ideal fits your demands. Answer a few questions, as well as we'll place strategies that finest fit your requirements.

Are you freshly eligible for Medicare? You might have been covered by exclusive insurance your entire life, so you may be wondering what to do. If you're cynical concerning the top quality of Medicare vs. exclusive insurance policy, you could like to understand that you can really have both. Medicare deals with private insurance provider to offer Medicare advantages.

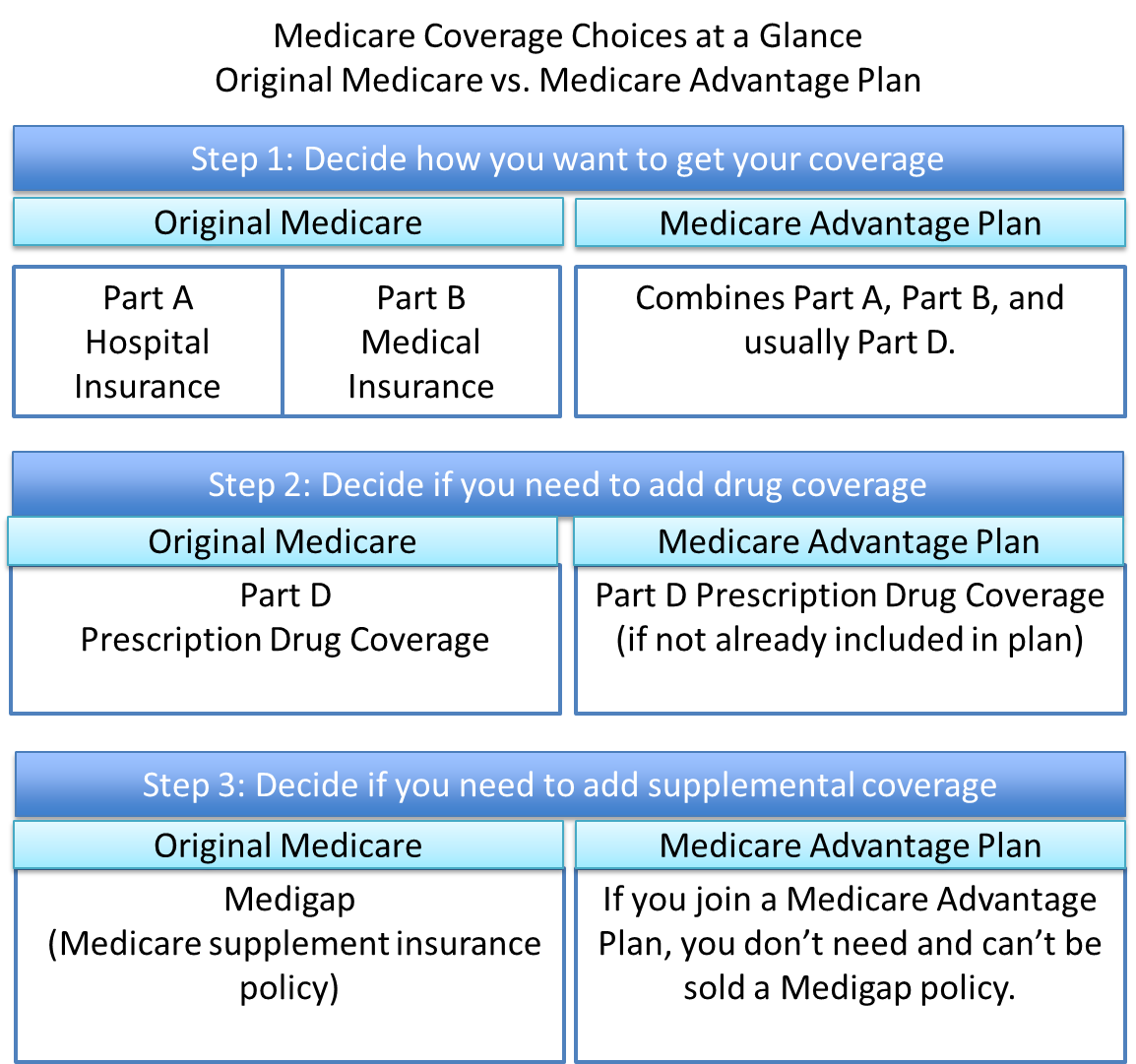

Medicare Advantage plans also could consist of added advantages, like prescription medicines, routine vision, routine hearing, and routine dental coverage. Regardless of which coverage alternative you might select, you're still in the Medicare program. You still need to stay registered in Medicare Part An and Part B to receive Medicare Benefit or Medicare Supplement.

The smart Trick of Paul B Insurance Part D That Nobody is Discussing

Yes, you can keep your private insurance coverage and also still register in Medicare. Medicare is a government health insurance coverage program for people that are 65 or older, individuals with specific specials needs, as well as people with end-stage renal disease.

Other Medicare Supplement plans might still aid you cover Medicare's out-of-pocket expenses. All Medicare Advantage strategies are needed to have an out-of-pocket limit, safeguarding you from devastating economic obligation if you have a major health problem. Limitations may differ among strategies. Normally, private insurer can increase your costs based upon three points that don't influence your Original Medicare costs.

Lots of people with Medicare do pay a premium for medical insurance policy (Part B) however this premium does not increase or down relying on your age. Location: According to Health care. gov, where you live has a big impact on your premiums from private insurance policy companies. The Medicare Component website here An and also Medicare Part B premiums are the exact same despite your location in the U.S.A..

What Does Paul B Insurance Part D Do?

Premiums and various other expenses may likewise be different among insurance provider. Tobacco use: Cigarette usage will certainly not raise your Initial Medicare (Part An and Part B) costs. Nonetheless, according to Medicare. gov, Medicare Supplement strategies may offer discounts to non-smokers. Private wellness insurance policy usually allows you to expand insurance coverage to dependents, such as your partner and also youngsters.

Many people with Medicare coverage need to certify by themselves via age or special needs. Original Medicare has some substantial spaces in protection for points that personal insurance generally covers, like prescription medications. Original Medicare might cover prescription drugs you receive in the hospital or particular medicines (such as shots or mixtures) you get in a doctor's workplace, but usually doesn't cover look at this now the majority of prescription medications you take in the house.